Covid-19 credits

On this page you will find information and data related to Covid-19 bridging credits.

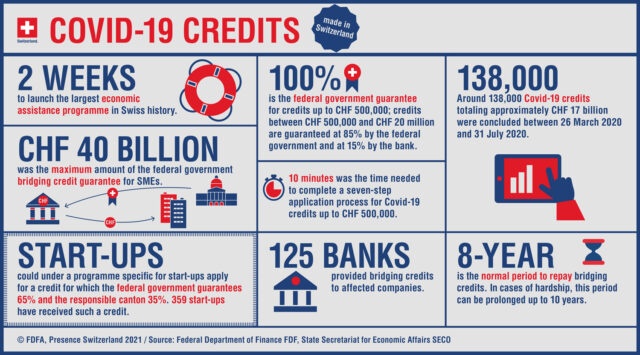

On this page, you will find information and data about Covid-19 credits for companies. To ensure liquidity, companies affected by the Covid-19 crisis were eligible to apply for bridging credits guaranteed by the federal government between March 26th 2020 and July 31st 2020.

Table of contents

- Current: Possibility of interest rate adjustment for COVID-19 credits at end of March 2026

- Covid-19 bridging credits overview

- Partially repaid Covid-19 bridging credits

- Fully repaid Covid-19 bridging credits

- Honoring on guarantees under the Covid-19 bridging credits

- Receivables management after honoring of guarantees under the Covid-19 bridging credits

- Federal provisions

- Further analyses of the bridging credits granted

- Reports of abuse

- Open cases after criminal complaint

- Closed cases after criminal complaint

- Banks: Participation list, documents and information

- Legal basis

- Media releases

- Interim report on Covid-19 solidary guarantee loans

- Parliamentary initiatives

- Other information

- Media contact

Covid-19 bridging credits overview

The table below provides an overview of Covid-19 credits granted, Covid-19 bridging credits that have been fully repaid to date, the Covid-19 bridging credits with amounts honored to date and, as a result, the Covid-19 bridging credits that are still outstanding.

Covid-19 bridging credits overview

| Credit type | Number of credits | Average amount in CHF | Granted credit volume in CHF |

|

|---|---|---|---|---|

| Granted Covid-19 credits | Covid-19 credits up to CHF 500'000 | 136'737 | 101'768 | 13'915'431'578 |

| Covid-19 credit plus | 1'133 | 2'645'751 | 2'997'636'171 | |

| Total | 137'870 | 122'674 | 16'913'067'749 | |

| Fully repaid Covid-19 credits | Covid-19 credits up to CHF 500'000 | 58'767 | 132'694 | 7'798'016'731 |

| Covid-19 credit plus | 987 | 2'667'629 | 2'632'950'206 | |

| Total | 59'754 | 174'565 | 10'430'966'937 | |

| Covid-19 credits with honored volume | Covid-19 credits up to CHF 500'000 | 22'628 | 73'871 | 1'671'557'656 |

| Covid-19 credit plus | 47 | 2'533'104 | 119'055'867 | |

| Total | 22'675 | 78'969 | 1'790'613'523 | |

| Total current Covid-19 credits (without taking partial amortisations into account) | 55'441 | 84'621 | 4'691'487'289 | |

Note: The figures for Covid-19 credits plus and the respective totals are based on the total amount of credit granted and not only the 85% share guaranteed by the federal government.

Last updated: 25.02.2026

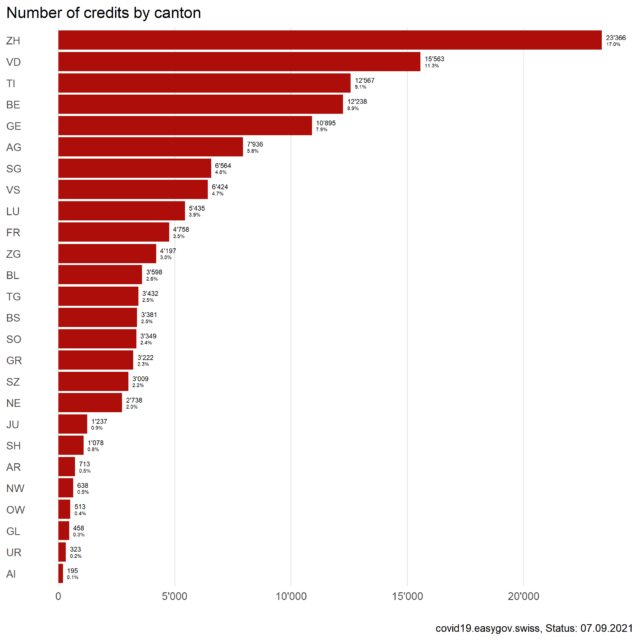

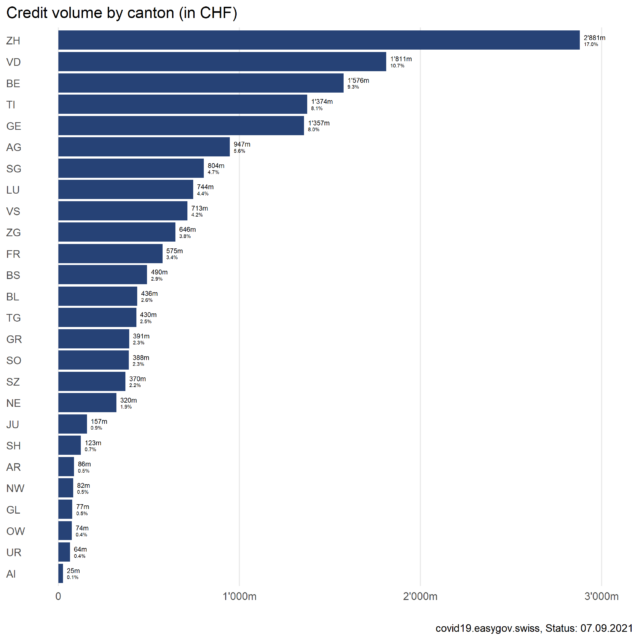

Covid-19 bridging credits overview by canton

| Canton | Granted Covid-19 credits | Fully repaid Covid-19 credits | Covid-19 credits with honored volume | ||||

| Number | Amount granted in CHF | Number | Amount granted in CHF | Number | Amount granted in CHF | Amount honored in CHF | |

| AG | 7'949 | 930'151'801 | 3'610 | 584'492'836 | 1'440 | 112'837'571 | 93'687'698 |

| AI | 188 | 24'053'961 | 128 | 19'070'592 | 25 | 1'214'519 | 1'113'090 |

| AR | 728 | 87'384'613 | 330 | 55'664'886 | 164 | 13'111'796 | 10'621'938 |

| BE | 12'163 | 1'571'083'669 | 5'694 | 1'004'182'629 | 1'628 | 115'703'828 | 90'716'334 |

| BL | 3'607 | 434'810'358 | 1'594 | 264'765'360 | 551 | 46'247'839 | 38'495'461 |

| BS | 3'360 | 483'254'532 | 1'355 | 294'242'488 | 666 | 69'504'079 | 55'782'473 |

| FR | 4'798 | 573'846'863 | 2'168 | 338'119'163 | 738 | 54'323'135 | 43'883'321 |

| GE | 10'905 | 1'369'782'952 | 3'887 | 779'999'854 | 1'993 | 168'217'037 | 133'689'527 |

| GL | 450 | 74'788'351 | 204 | 56'124'851 | 73 | 3'957'814 | 3'339'991 |

| GR | 3'229 | 387'862'244 | 1'603 | 251'868'313 | 385 | 23'446'528 | 18'194'426 |

| JU | 1'298 | 161'845'329 | 510 | 100'382'508 | 166 | 11'171'108 | 8'604'627 |

| LU | 5'387 | 712'543'560 | 2'552 | 467'088'649 | 878 | 66'498'810 | 53'484'782 |

| NE | 2'739 | 320'609'403 | 1'311 | 209'989'529 | 351 | 23'124'472 | 18'308'019 |

| NW | 645 | 88'752'802 | 336 | 62'614'266 | 85 | 6'769'733 | 5'838'023 |

| OW | 502 | 65'323'747 | 255 | 38'626'103 | 61 | 6'930'444 | 5'177'928 |

| SG | 6'558 | 802'482'269 | 3'038 | 525'604'832 | 1'079 | 72'065'784 | 57'946'962 |

| SH | 1'067 | 124'310'195 | 580 | 85'883'850 | 152 | 12'728'941 | 8'996'419 |

| SO | 3'327 | 386'720'535 | 1'418 | 247'954'419 | 541 | 34'117'810 | 28'488'050 |

| SZ | 3'039 | 370'076'804 | 1'451 | 225'925'001 | 573 | 49'232'131 | 40'493'076 |

| TG | 3'430 | 430'566'676 | 1'478 | 274'280'233 | 575 | 44'087'749 | 37'581'949 |

| TI | 12'587 | 1'369'877'279 | 4'870 | 761'198'110 | 1'844 | 133'218'522 | 110'864'611 |

| UR | 316 | 62'026'337 | 165 | 43'516'128 | 43 | 5'112'633 | 4'419'247 |

| VD | 15'531 | 1'805'482'801 | 6'420 | 1'084'578'782 | 2'431 | 190'397'583 | 149'872'287 |

| VS | 6'415 | 701'252'484 | 2'944 | 417'872'655 | 817 | 50'478'811 | 38'992'383 |

| ZG | 4'273 | 661'869'934 | 1'974 | 402'033'439 | 961 | 124'226'961 | 94'272'431 |

| ZH | 23'379 | 2'912'308'250 | 9'879 | 1'834'887'462 | 4'455 | 351'887'887 | 290'259'630 |

| Total | 137'870 | 16'913'067'749 | 59'754 | 10'430'966'937 | 22'675 | 1'790'613'523 | 1'443'124'682 |

|---|---|---|---|---|---|---|---|

Last updated: 25.02.2026

Partially repaid Covid-19 bridging credits

The table below provides an overview of the amortisation payments made, e.g. the portion of the Covid-19 bridging credits partially repaid by the borrowers as the result of an amortisation plan. In accordance with Art. 11 of the Covid-19-Solidarbürgschaftsgesetzes (in German), the lenders are to inform the loan guarantee cooperatives biannually (at the end of March and at the end of September, respectively) as to the current state of the amortisations. The concrete form that the amortisation plan takes is determined by the company and the banks.

made in outstanding credits as of 30.09.2025 |

||||

| Number | Volume in CHF | Number | Volume in CHF | |

| Amortisation payments made | 57'815 | 2'985'727'135 | 99.8% | 59.5% |

Last updated: status september 2025

Fully repaid Covid-19 bridging credits

The tables below show the fully repaid Covid-19 bridging credits by year and by sector. After a full repayment, the corresponding guarantee organizations are released from the Covid-19 solidarity guarantee by the lenders. Partial repayments without guarantee exoneration are not shown in the table below.

Fully repaid Covid-19 bridging credits by year

| Number of credits | Share of fully repaid credits in outstanding credits at the beginning of the year | Average repaid amount in CHF | Repaid amounts in CHF | Share of repaid credit volume in outstanding credit volume at the beginning of the year |

|

|---|---|---|---|---|---|

| 2020 | 8'386 | 6.1% | 222'955 | 1'869'698'050 | 11.1% |

| 2021 | 15'118 | 11.7% | 211'563 | 3'198'402'216 | 21.4% |

| 2022 | 11'568 | 10.4% | 152'251 | 1'761'242'521 | 15.3% |

| 2023 | 12'335 | 13.2% | 135'838 | 1'675'562'428 | 17.8% |

| 2024 | 6'730 | 8.9% | 155'328 | 1'045'356'781 | 14.3% |

| 2025 | 5'207 | 8.0% | 161'487 | 840'862'529 | 14.2% |

| 2026 | 410 | 0.7% | 97'177 | 39'842'413 | 0.8% |

| Total | 59'754 | 43.3% | 174'565 | 10'430'966'937 | 61.7% |

Last updated: 25.02.2026

The ten sectors with the highest fully repaid credit volume (descending)

| Number of credits | Average repaid amount in CHF | Repaid amounts in CHF | Share of the sector’s repaid volume in total repaid volume | Share of the sector’s repaid volume in the sector’s granted credit volume |

|

|---|---|---|---|---|---|

| Wholesale trade, except of motor vehicles and motorcycles (G46) | 3'935 | 275'837 | 1'085'417'238 | 10% | 65% |

| Retail trade, except of motor vehicles and motorcycles (G47) | 5'219 | 157'177 | 820'307'626 | 8% | 60% |

| Specialised construction activities (F43) | 4'687 | 167'149 | 783'426'973 | 8% | 52% |

| Human health activities (Q86) | 4'542 | 139'850 | 635'196'784 | 6% | 76% |

| Wholesale and retail trade and repair of motor vehicles and motorcycles (G45) | 2'498 | 228'883 | 571'750'897 | 6% | 55% |

| Food and beverage service activities (I56) | 5'258 | 104'888 | 551'500'415 | 5% | 49% |

| Accomodation (I55) | 1'636 | 210'156 | 343'815'660 | 3% | 67% |

| Manufacture of fabricated metal products, except machinery and equipment (C25) | 1'169 | 272'798 | 318'900'703 | 3% | 66% |

| Architectural and engineering activities; technical testing and analysis (M71) | 2'240 | 141'532 | 317'031'058 | 3% | 64% |

| Computer programming, consultancy and related activities (J62) | 1'710 | 167'037 | 285'632'424 | 3% | 67% |

| All other sectors * | 26'860 | 175'651 | 4'717'987'159 | 45% | 63% |

| Total | 59'754 | 174'565 | 10'430'966'937 | 100% | 62% |

*The Federal Statistical Office (FSO) publishes a list of all sectors (2-digit NOGA codes) on its website.

Last updated: 25.02.2026

Honoring on guarantees under the Covid-19 bridging credits

The following tables provide information on the honoring of guarantees under the Covid-19 bridging loan programme, by year, by banking group and by sector. These are Covid-19 bridging loans for which the banks have drawn down the guarantee. With the transfer of the honored amount from the guarantee organisations to the banks, the claims against the borrowers are transferred to the guarantee organisations. The honored amount may differ from the credit volume granted, as the banks only call on the guarantee for the portion of the loan that the borrowers have used. Reported here are the guarantees as reported by the guarantee organisations, which may differ from federal expenditures as stated in the government financial statements due to differences in the timing of the accounting entries.

Honoring on guarantees by year

| Number of credits | Share of honored guarantees in outstanding credits at the beginning of the year | Average honored amount in CHF | Honored amounts in CHF | Credit volume granted in CHF | Share of honored volume in outstanding credit volume at the beginning of the year |

|

|---|---|---|---|---|---|---|

| 2020 | 665 | 0.5% | 82'688 | 54'987'750 | 62'840'399 | 0.3% |

| 2021 | 2'898 | 2.2% | 78'506 | 227'509'634 | 246'966'168 | 1.5% |

| 2022 | 5'493 | 5.0% | 65'829 | 361'600'843 | 378'604'852 | 3.1% |

| 2023 | 5'533 | 5.9% | 67'793 | 375'096'224 | 430'884'351 | 4.0% |

| 2024 | 3'969 | 5.2% | 59'817 | 237'413'037 | 325'413'184 | 3.3% |

| 2025 | 3'756 | 5.8% | 45'943 | 172'562'008 | 314'654'242 | 2.9% |

| 2026 | 361 | 0.7% | 38'657 | 13'955'186 | 31'250'328 | 0.3% |

| Total | 22'675 | 16.4% | 63'644 | 1'443'124'682 | 1'790'613'523 | 10.6% |

Last updated: 25.02.2026

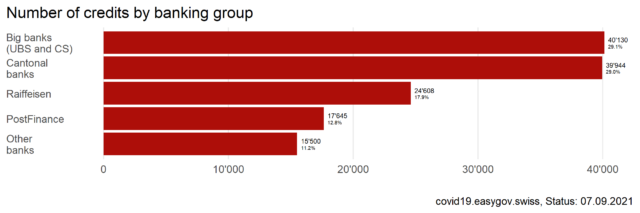

Honoring on guarantees by banking group

| Number of credits | Average honored amount in CHF | Honored amounts in CHF | Share of the banking group's honored volume in total honored volume |

|

|---|---|---|---|---|

| Big banks * | 7'660 | 78'523 | 601'485'245 | 41% |

| Cantonal banks | 5'558 | 64'937 | 360'920'678 | 25% |

| PostFinance | 4'148 | 41'969 | 174'089'114 | 12% |

| Raiffeisen banks | 3'238 | 51'630 | 167'177'919 | 12% |

| Other banking institutions | 2'071 | 67'335 | 139'451'727 | 10% |

| Total | 22'675 | 63'644 | 1'443'124'682 | 100% |

* Credit Suisse and UBS

Last updated: 25.02.2026

The ten sectors with the highest honored credit volume (descending)

| Number of credits | Average honored amount in CHF | Honored amounts in CHF | Share of the sector’s honored volume in total honored volume | Share of the sector’s honored volume in the sector’s granted credit volume |

|

|---|---|---|---|---|---|

| Specialised construction activities (F43) | 3'305 | 66'782 | 220'714'341 | 15% | 15% |

| Wholesale trade, except of motor vehicles and motorcycles (G46) | 1'388 | 101'029 | 140'228'252 | 10% | 8% |

| Food and beverage service activities (I56) | 3'269 | 41'451 | 135'502'184 | 9% | 12% |

| Retail trade, except of motor vehicles and motorcycles (G47) | 1'770 | 66'039 | 116'889'546 | 8% | 8% |

| Construction of buildings (F41) | 1'137 | 86'676 | 98'550'237 | 7% | 18% |

| Wholesale and retail trade and repair of motor vehicles and motorcycles (G45) | 875 | 78'263 | 68'480'021 | 5% | 7% |

| Activities of head offices; management consultancy activities (M70) | 858 | 50'851 | 43'629'807 | 3% | 14% |

| Architectural and engineering activities; technical testing and analysis (M71) | 538 | 80'404 | 43'257'225 | 3% | 9% |

| Real estate activities (L68) | 506 | 80'770 | 40'869'503 | 3% | 14% |

| Land transport and transport via pipelines (H49) | 990 | 40'079 | 39'678'558 | 3% | 10% |

| All other sectors * | 8'039 | 61'615 | 495'325'008 | 34% | 6% |

| Total | 22'675 | 63'644 | 1'443'124'682 | 100% | 8% |

*The Federal Statistical Office (FSO) publishes a list of all sectors (2-digit NOGA codes) on its website.

Last updated: 25.02.2026

Receivables management after honoring of guarantees under the Covid-19 bridging credits

The following table provides information on the receivables management of the honored guarantees under the Covid-19 bridging credits. After the guarantee has been honored, the outstanding receivables from the respective Covid 19 bridging credit are transferred from the lending bank to the guarantee organization for receivables management. In the course of the receivables management, the guarantee organizations take all necessary precautions to recover outstanding receivables (recoveries). The receivables management is discontinued if either the entire outstanding amount has been recovered or no further recoveries are possible (uncollectible receivables). In the case of uncollectible receivables, a distinction is made between guarantees for which it was possible to recover part of the amount honored (partial loss) and those for which it was not possible to generate any recoveries (total loss). Reasons for incurring uncollectible receivables after honoring guarantees under the Covid-19 bridging credits are: The borrower is a dissolved or bankrupt corporation. The borrower is deceased.1

Overview of receivables management

| Number | Amount granted in CHF | Amount honored in CHF | Recoveries in CHF | Uncollectible amounts receivable in CHF 2 |

||

|---|---|---|---|---|---|---|

| Receivables management discontinued | with recoveries (100% repaid) 3 1'094 | 55'303'514 | 40'868'992 | 40'516'590 | 0 |

|

| with recoveries (partial loss) | 659 | 76'751'923 | 63'623'540 | 12'006'519 | 51'617'020 | |

| without recoveries (total loss) | 3'138 | 190'036'944 | 163'191'748 | 0 | 163'191'748 | |

| Total cases with discontinued receivables management | 4'891 | 322'092'381 | 267'684'279 | 52'523'109 | 214'808'768 | |

| Receivables management ongoing | 17'784 | 1'468'521'142 | 1'175'440'402 | 79'665'291 | 0 | |

| Total | 22'675 | 1'790'613'523 | 1'443'124'682 | 132'188'400 | 214'808'768 | |

Last updated: 25.02.2026

1 In cases of bankruptcy and decease, uncollectible receivables may arise due to a lack of assets or because a loss certificate issued to the guarantee organization cannot be further managed.

2 The uncollectible receivables amounts are calculated from the honored guarantee volume less the recoveries.

3 In cases of abuse under the Covid-19-Solidarbürgschaftsverordnung and the Covid-19-Solidarbürgschaftsgesetz, recoveries can exceed the amount honored due to interests on late payments and damage interests.

Receivables management: recoveries by year of honoring the guarantee

The table below provides information on guarantees under the Covid-19 bridging credits honored in the year indicated, for which recoveries have resulted to date.

| Number of guarantees honored with recoveries | Recoveries in CHF | Honored amounts in CHF | Share of recoveries of amounts honored |

|

|---|---|---|---|---|

| 2020 | 261 | 8'346'735 | 22'782'250 | 37% |

| 2021 | 975 | 27'161'942 | 69'700'238 | 39% |

| 2022 | 1'619 | 33'656'212 | 97'700'011 | 35% |

| 2023 | 1'877 | 35'304'914 | 116'980'488 | 30% |

| 2024 | 1'380 | 20'089'440 | 72'716'565 | 28% |

| 2025 | 986 | 7'571'887 | 36'628'066 | 21% |

| 2026 | 11 | 57'270 | 483'576 | 12% |

| Total | 7'109 | 132'188'400 | 416'991'195 | 32% |

Last updated: 25.02.2026

Federal provisions

The table below provides an overview of the honoring of guarantees expected in the future. These estimates are updated annually. As of the end of 2024, the federal government has recognised provisions for CHF 472 million for future honoring of guarantees until the end of the programme. Actual losses can only be determined after the end of the bridging loan programme and after the completion of the receivables management (see also: Recoveries after honoring guarantees under the Covid-19 bridging credits).

| Federal provisions for future honoring of guarantees | Portion of the outstanding loan volume as of the end of the year |

|

|---|---|---|

| 2024 | 472 million | 7.7% |

Further analyses of the bridging credits granted

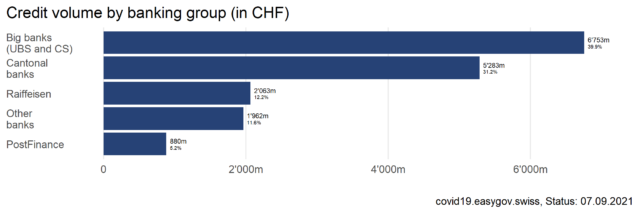

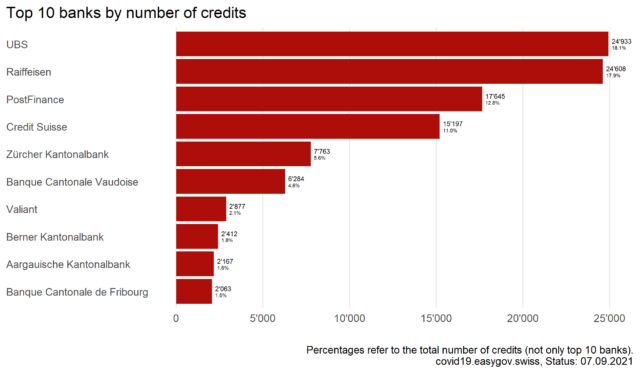

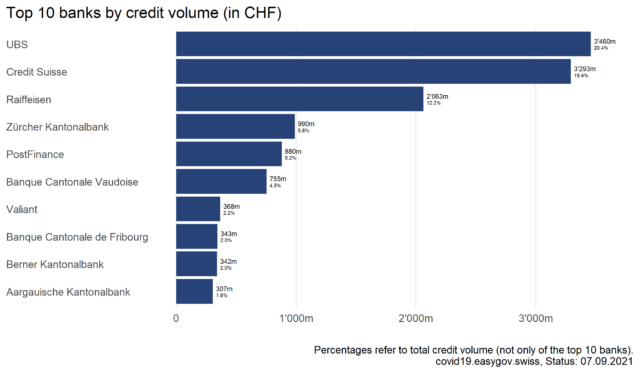

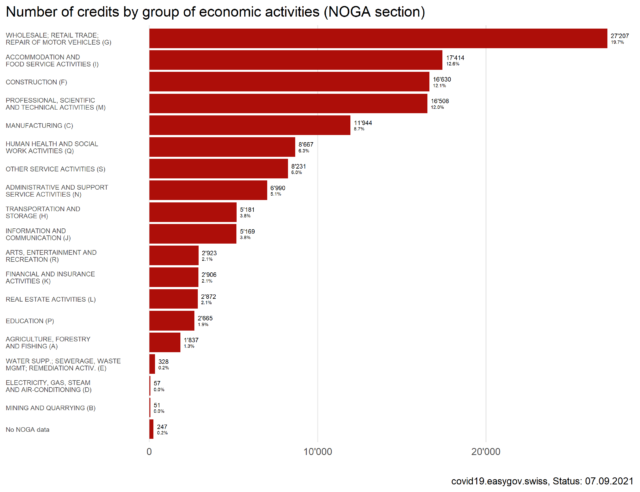

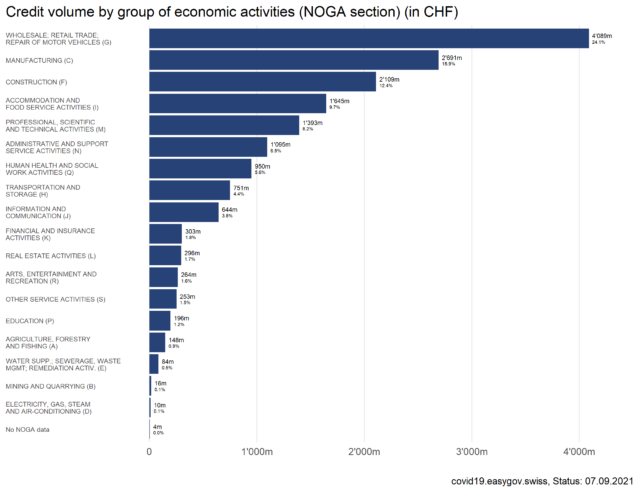

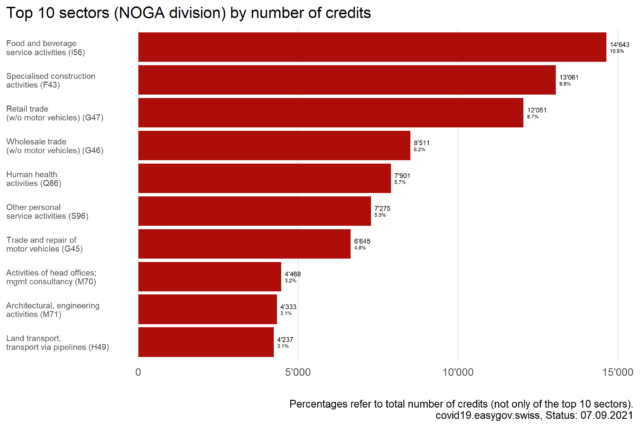

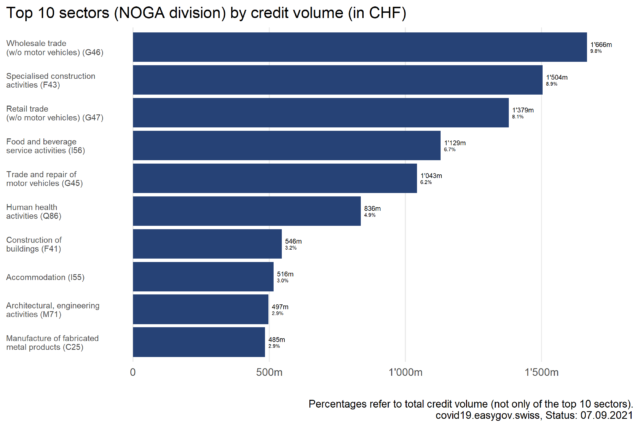

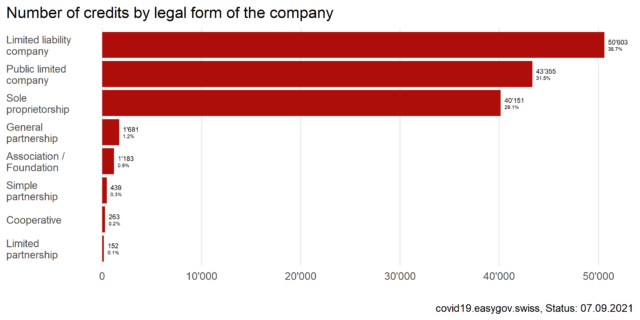

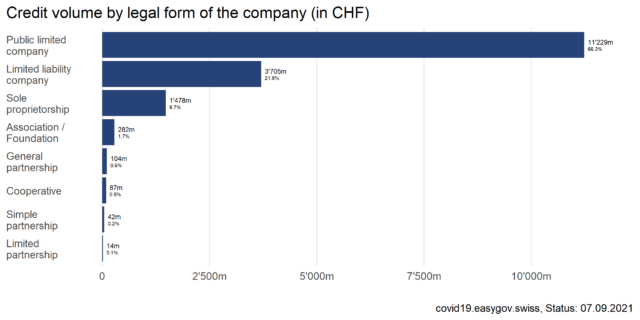

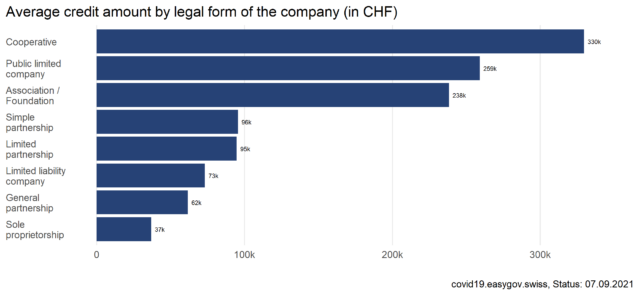

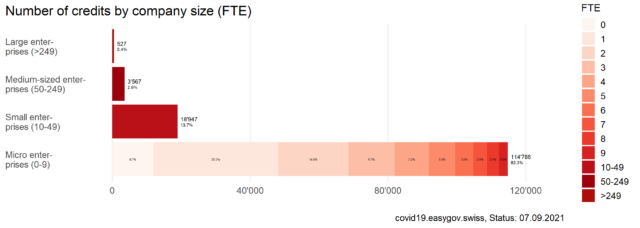

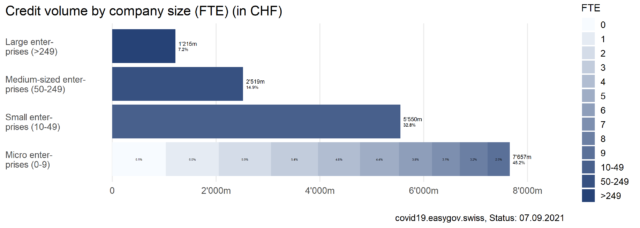

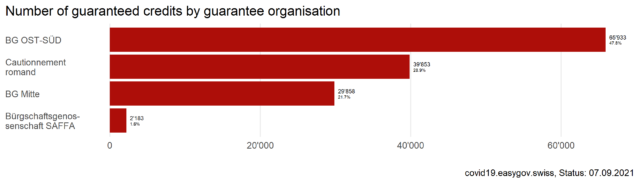

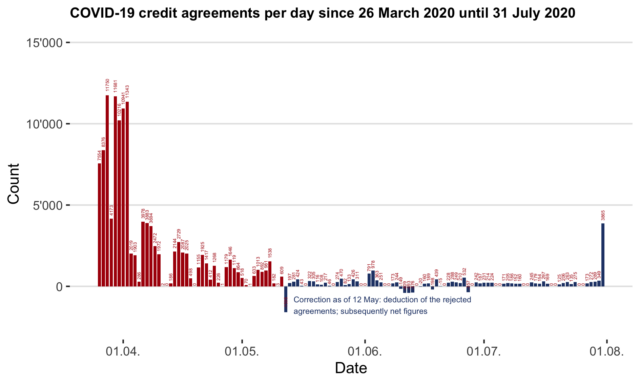

The following charts illustrate distributions of granted Covid-19 bridging credits by selected specifications, such as canton or sector. These visualizations provide background knowledge and are based on data from the guarantee organizations. In order to exclude any conclusions about individual companies and to guarantee their anonymity, only aggregated data can be made available. Due to rounding, it is possible that the sum of the shares may not be 100%.

Status: 07.09.2021

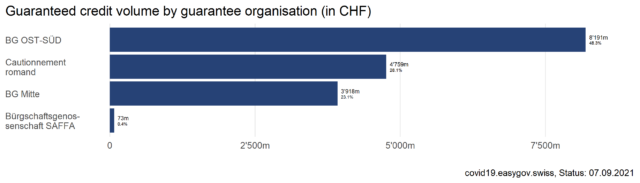

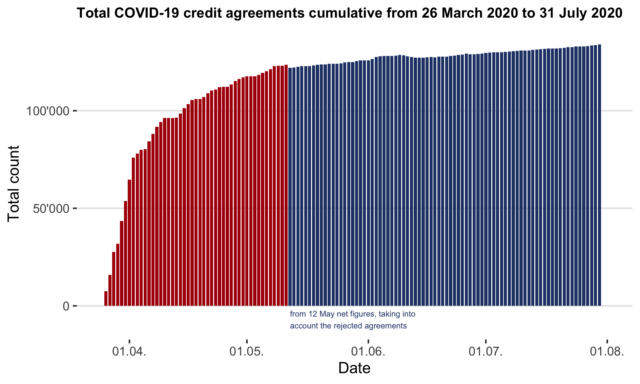

The following two figures illustrate the development over time of the granting of Covid-19 bridging credits up to 500’000 Swiss francs and are based on the data of the guarantee organizations.

Last updated: 24.04.2024

Reports of abuse

The table below contains potential and actual cases of abuse under the Covid-19-Solidarbürgschaftsverordnung (in German) and the Covid-19-Solidarbürgschaftsgesetz (in German). Here you find the concept for the detection and prevention of abuse (in German). The statistics show the cases of which the loan guarantee cooperatives are aware, either because they have filed a criminal complaint themselves or because they have been informed about them by third parties. They are not complete with regard to criminal charges of which the loan guarantee cooperatives are not aware. The statistics are updated on an ongoing basis.

| Types of abuse (all types according to the ordinance) | In clarifi- cation | Abuse not confirmed | Correction without filing of criminal complaint | Without charge –clarification discon- tinued* | ||||

| Open cases | Closed cases | |||||||

| Number | Delin- quency amount in CHF*** | Number | Delin- quency amount in CHF*** |

|||||

| Multiple applications (Art. 3, para. 1) | 5 | 101 | 211 | 2 | 42 | 6'336'585 | 93 | 12'560'527 |

| Date of foundation (Art. 3, para. 1, a.) | 6 | 121 | 168 | 3 | 9 | 657'300 | 20 | 809'534 |

| In bankruptcy, estate or liquidation (Art. 3, para. 1, b.) | 5 | 16 | 27 | 4 | 18 | 1'603'490 | 38 | 2'823'294 |

| Sales information (Art. 7, para. 1) | 195 | 1'004 | 1'716 | 47 | 461 | 89'515'562 | 331 | 41'757'902 |

| Support for other emergency regulations (Art. 3, para. 1, d.) | 4 | 1 | 2 | 0 | 2 | 450'000 | 1 | 45'000 |

| Use of credit in general and replacement investments (Art. 6, para. 1 und 2)1 | 2'034 | 667 | 1'450 | 376 | 2'396 | 257'680'580 | 1'833 | 131'398'397 |

| Use of credit dividends, refinancing, etc. (Art. 6, para. 3)2 | 207 | 366 | 2'806 | 18 | 131 | 15'171'545 | 76 | 8'938'667 |

| Others | 243 | 131 | 206 | 24 | 306 | 36'776'760 | 340 | 29'862'557 |

| Total | 2'699 | 2'407 | 6'586 | 474 | 3'365 | 408'191'822 | 2'732 | 228'195'878 |

|---|---|---|---|---|---|---|---|---|

*Cases in which no criminal complaints have been filed and the borrower, respectively its governing bodies as well as all persons involved in the management or liquidation of the borrower, insofar as they would be liable, are deceased or missing. If a missing person reappears, the case can be reopened.

**Including criminal complaints from third parties of which the loan guarantee cooperatives are aware.

***The reported delinquency amount corresponds to the volume of credits at the time they were granted. This amount therefore doesn’t represent the actual financial damage resulting from a punishable or illicit act.

1 As of the commencement of the Covid-19-Solidarbürgschaftsgesetz (Covid-19-SBüG) (in German) on December 19, 2020, the prohibition to carry out new investments in fixed assets that are not replacement investments has been lifted (cf. Art. 27 para. 2 Covid-19-SBüG).

2 As of the commencement of the Covid-19-SBüG on December 19, 2020, already the decision on the payment of dividends is unlawful (cf. Art. 2 para. 2 lit. a Covid-19-SBüG and Official Bulletin: AB 2020 N 2040 of October 30, 2020, and AB 2020 S 1314 f. of December 10, 2020).

Last updated: 25.02.2026

In addition, the statistics from the Money Laundering Reporting Office (MROS) showed all a) reports according to the Money Laundering Act or the Criminal Code, as well as b) the number of complaints filed by MROS with law enforcement agencies (according to Art. 23 para. 4 Money Laundering Act) until the end of 2021. The MROS statistics can show cases that are also included in the above table of abuse reports.

Open cases after criminal complaint

The following table shows the open cases after criminal complaints have been filed of which the loan guarantee cooperatives are aware, either because they filed the criminal complaints themselves or because they were informed about them by third parties. It is not complete with regard to criminal complaints of which the loan guarantee cooperatives have no knowledge. The statistics are updated on an ongoing basis.

Open cases after criminal complaint per canton

| Canton | Criminal complaint filed: open cases* | |

| Number | Delinquency amount in CHF ** | |

| AG | 221 | 25'822'407 |

| AI | 4 | 298'172 |

| AR | 25 | 2'575'326 |

| BE | 155 | 18'091'310 |

| BL | 78 | 13'434'918 |

| BS | 60 | 9'887'274 |

| FR | 191 | 22'035'892 |

| GE | 509 | 58'671'022 |

| GL | 10 | 597'648 |

| GR | 30 | 2'467'910 |

| JU | 12 | 1'283'553 |

| LU | 98 | 16'916'120 |

| NE | 70 | 8'061'604 |

| NW | 11 | 2'077'700 |

| OW | 14 | 1'980'047 |

| SG | 124 | 9'131'364 |

| SH | 11 | 522'516 |

| SO | 48 | 6'086'871 |

| SZ | 63 | 9'901'896 |

| TG | 75 | 6'915'898 |

| TI | 173 | 17'893'048 |

| UR | 6 | 894'640 |

| VD | 538 | 63'637'767 |

| VS | 135 | 13'848'470 |

| ZG | 171 | 26'964'172 |

| ZH | 533 | 68'194'277 |

| Total | 3'365 | 408'191'822 |

|---|---|---|

*Including criminal complaints filed by third parties of which the loan guarantee cooperatives are aware.

**The reported delinquency amount corresponds to the volume of credits at the time they were granted. This amount therefore doesn’t represent the actual financial damage resulting from a punishable or illicit act.

Last updated: 25.02.2026

Closed cases after criminal complaint

Below is a table with the closed cases by type of abus, by canton and a table of guilty verdicts by industry after criminal complaints have been filed. These are criminal complaints of which the loan guarantee cooperatives are aware, either because they filed the criminal complaints themselves or because they have been informed about them by third parties. It is not complete with regard to criminal complaints of which the loan guarantee cooperatives have no knowledge. The statistics are updated on an ongoing basis.

Closed cases by type of abuse

| Types of abuse (all types according to the ordinance) | No criminal proceed- ings: Non- pro- secution | |||||||

| Innocent | Reparation | Guilty | Criminal proceedings discontinued* |

|||||

| Number | Number | Delin- quency amount in CHF** | Number | Delin- quency amount in CHF** | Number | Delin- quency amount in CHF** |

||

| Multiple applications (Art. 3, para. 1) | 2 | 8 | 8 | 1'168'200 | 74 | 10'403'423 | 1 | 70'119 |

| Date of foundation (Art. 3, para. 1, a.) | 0 | 5 | 0 | 0 | 15 | 684'334 | 0 | 0 |

| In bankruptcy, estate or liquidation (Art. 3, para. 1, b.) | 3 | 7 | 4 | 149'900 | 23 | 1'150'567 | 1 | 80'000 |

| Sales information (Art. 7,para. 1) | 15 | 57 | 41 | 4'824'747 | 210 | 25'057'299 | 8 | 1'620'000 |

| Support for other emergency regulations (Art. 3, para. 1 ,d.) | 0 | 0 | 0 | 0 | 1 | 45'000 | 0 | 0 |

| Use of credit in general and replacement investments (Art. 6, para. 1 and 2)1 | 71 | 383 | 130 | 12'010'408 | 1'228 | 79'403'372 | 21 | 2'058'864 |

| Use of credit dividends, refinancing, etc. (Art. 6, para. 3)2 | 5 | 17 | 9 | 645'824 | 43 | 4'861'120 | 2 | 210'000 |

| Others | 8 | 86 | 52 | 6'386'349 | 184 | 14'613'613 | 10 | 1'217'400 |

| Total | 104 | 563 | 244 | 25'185'428 | 1'778 | 136'218'728 | 43 | 5'256'383 |

|---|---|---|---|---|---|---|---|---|

*Cases in which the criminal proceedings have been discontinued and the borrower, respectively its governing bodies as well as all persons involved in the management or liquidation of the borrower, insofar as they would be liable, are deceased or missing. If a missing person reappears, the case can be reopened.

**The reported delinquency amount corresponds to the volume of credits at the time they were granted. This amount therefore doesn’t represent the actual financial damage resulting from a punishable or illicit act.

1 As of the commencement of the Covid-19-Solidarbürgschaftsgesetz (Covid-19-SBüG) (in German) on December 19, 2020, the prohibition to carry out new investments in fixed assets that are not replacement investments has been lifted (cf. Art. 27 para. 2 Covid-19-SBüG).

2 As of the commencement of the Covid-19-SBüG on December 19, 2020, already the decision on the payment of dividends is unlawful (cf. Art. 2 para. 2 lit. a Covid-19-SBüG and Official Bulletin: AB 2020 N 2040 of October 30, 2020, and AB 2020 S 1314 f. of December 10, 2020).

Last updated: 25.02.2026

Closed cases by canton

| Canton | Criminal complaint filed: closed cases | |

| Number | Delinquency amount in CHF* | |

| AG | 168 | 13'700'060 |

| AI | 5 | 181'000 |

| AR | 23 | 2'444'800 |

| BE | 160 | 13'458'990 |

| BL | 73 | 6'355'101 |

| BS | 139 | 13'235'891 |

| FR | 107 | 6'213'827 |

| GE | 217 | 20'046'993 |

| GL | 3 | 1'027'300 |

| GR | 35 | 3'208'248 |

| JU | 8 | 572'500 |

| LU | 124 | 15'829'285 |

| NE | 37 | 2'569'650 |

| NW | 13 | 1'301'900 |

| OW | 7 | 238'326 |

| SG | 139 | 7'282'546 |

| SH | 5 | 661'000 |

| SO | 88 | 6'930'422 |

| SZ | 68 | 6'616'496 |

| TG | 32 | 3'229'900 |

| TI | 130 | 10'233'209 |

| UR | 5 | 276'000 |

| VD | 354 | 27'193'236 |

| VS | 117 | 6'682'023 |

| ZG | 75 | 10'896'763 |

| ZH | 600 | 47'810'413 |

| Total | 2'732 | 228'195'878 |

|---|---|---|

*The reported delinquency amount corresponds to the volume of credits at the time they were granted. This amount therefore doesn’t represent the actual financial damage resulting from a punishable or illicit act.

Last updated: 25.02.2026

Guilty verdicts by industry

guilty |

||

| Number | Delinquency amount in CHF* | |

| Specialised construction activities (F43) | 393 | 29'842'872 |

| Food and beverage service activities (I56) | 238 | 15'367'059 |

| Construction of buildings (F41) | 161 | 13'255'532 |

| Retail trade, except of motor vehicles and motorcycles (G47) | 104 | 10'197'727 |

| Wholesale trade, except of motor vehicles (G46) | 79 | 6'527'812 |

| Services to buildings and landscape activities (N81) | 77 | 4'403'725 |

| Wholesale and retail trade and repair of motor vehicles and motorcycles (G45) | 68 | 5'788'502 |

| Land transport and transport via pipelines (H49) | 67 | 2'988'003 |

| Activities of head offices; management consultancy activities (M70) | 61 | 4'747'893 |

| Other personal service activities (S96) | 55 | 2'631'824 |

| All other industries** | 475 | 40'467'779 |

| Total | 1'778 | 136'218'728 |

|---|---|---|

*The reported delinquency amount corresponds to the volume of credits at the time they were granted. This amount therefore doesn’t represent the actual financial damage resulting from a punishable or illicit act.

**The Federal Statistical Office (FSO) publishes a list of all sectors (2-digit NOGA codes) on its website.

Last updated: 25.02.2026

Banks: Participation list, documents and information

Here is a list of the 125 banks that have granted Covid-19 loans.

Bank-specific documents:

- Framework regarding Covid-19 loans up to CHF 500,000 for participating banks

- Guarantee contract (09.04.2020)

Bank-specific information:

- Swiss Bankers Association: www.swissbanking.org: Coronavirus – Swiss financial centre

- Swiss Financial Market Supervisory Authority FINMA: www.finma.ch | Media release of 25.03.2020

- Swiss National Bank SNB: www.snb.ch | Media release of 25.03.2020

Legal basis

- Verordnung über die Anpassung der Zinssätze nach dem Covid-19-Solidarbürgschaftsgesetz (german) (21.03.2025)

- Erläuterungen zur Verordnung über die Anpassung der Zinssätze nach dem Covid-19-Solidarbürgschaftsgesetz (german) (21.03.2025)

- Bundesgesetz über Kredite mit Solidarbürgschaft infolge des Coronavirus (german) (18.12.2020)

- Botschaft zu Änderungen des Covid-19-Gesetzes und des Covid-19-Solidarbürgschaftsgesetzes (german) (18.11.2020)

- Entwurf für das Bundesgesetz über Kredite mit Solidarbürgschaft infolge des Coronavirus (german) (18.09.2020)

- Botschaft zum Bundesgesetz über Kredite mit Solidarbürgschaft infolge des Coronavirus (german) (18.09.2020)

- Vorentwurf für das Bundesgesetz über Kredite mit Solidarbürgschaft infolge des Coronavirus (german) (01.07.2020)

- Erläuternder Bericht zum Vorentwurf des Bundesgesetzes über Kredite mit Solidarbürgschaft infolge des Coronavirus (german) (01.07.2020)

- Notverordnung zur Gewährung von Krediten und Solidarbürgschaften infolge des Coronavirus (german) (25.03.2020)

- Erläuterungen zur Notverordnung zur Gewährung von Krediten und Solidarbürgschaften in Folge des Coronavirus (german) (14.04.2020)

Media releases

- Information as of 24.02.2026

Possibility of interest rate adjustment for COVID-19 credits at end of March 2026 - Media release of 21.03.2025

Federal Council lowers interest rates for COVID-19 credits - Information as of 25.02.2025

Possibility of interest rate adjustment for COVID-19 credits at end of March 2025 - Media release of 27.03.2024

Federal Council leaves interest rates for COVID-19 credits unchanged - Information as of 22.02.2024

Possibility of interest rate adjustment for COVID-19 credits at end of March 2024 - Media release of 29.11.2023

Bundesrat verabschiedet Zwischenbericht zu den Covid-19-Solidarbürgschaftskrediten - Media release of 29.03.2023

Federal Council adjusts interest rates for Covid-19 credits - Media release of 02.02.2022

Covid-19-Kredite: Bundesrat belässt Zinsen unverändert und begrüsst Amortisationsregelungen - Media release of 17.02.2021

Coronavirus: Bundesrat erweitert Unterstützung für grössere Unternehmen und Arbeitslose - Media release of 27.01.2021

Coronavirus: Bundesrat stockt Härtefallprogramm auf und stärkt Arbeitslosenversicherung - Media release of 13.01.2021

Coronavirus: Bund baut Unterstützung über das Härtefallprogramm aus - Media release of 18.11.2020

Coronavirus: Federal Council adjusts Covid-19 support measures to second wave - Media release of 18.09.2020

Coronavirus: Federal Council adopts dispatch on new Joint and Several Guarantee Act - Media release of 01.07.2020

Coronavirus: Emergency ordinance on Covid-19 credits to be incorporated into ordinary law - Media release of 15.05.2020

Covid-19 Kredite: Konzept zur Missbrauchsbekämpfung verabschiedet (with first version of the audit concept for preventing abuse) - Media release of 03.04.2020

Federal Council increases volume of liquidity assistance guarantees to CHF 40 billion - Media release of 25.03.2020

Coronavirus: Federal Council adopts emergency ordinance on granting of credits with joint and several federal guarantees - Media release of 20.03.2020

Coronavirus: Massnahmenpaket zur Abfederung der wirtschaftlichen Folgen

Interim report on Covid-19 solidary guarantee loans

The Federal Council’s interim report on Covid-19 joint and several guarantee loans provides an initial interim assessment of the Covid-19 loans granted, the loans outstanding and repaid and the honored guarantees as at June 2023. The report also addresses the issue of combating abuse and compares the costs of the Covid-19 solidarity guarantee programme with the social benefits created by the programme.

Parliamentary initiatives

The following table shows the parliamentary initiatives related to the Covid-19 bridging credits program.

Other information

- Bundesrat verabschiedet Bericht zu den wirtschaftlichen Folgen der Corona-Krise

- Stellungnahmen aus der Vernehmlassung zum Covid-19-Solidarbürgschaftsgesetz (german)

- Current version of the audit concept for preventing abuse (german) (23.06.2020)

- Process graphic «Covid-19 credit»

- Process graphic «Covid-19 plus credit»

- Fuhrer, Lucas Marc/Ramelet, Marc-Antoine/Tenhofen, Jörn (2020). Firms’ participation in the Covid-19 loan programme, SNB Working Papers No. 25/2020, Swiss National Bank.

-

- KOF Konjunkturforschungsstelle ETH Zürich (2021). Firmenkonkurse schiessen im Mai nach oben. (german)

- «Audit of the involvement of third parties in the implementation of Covid-19 measures – State Secretariat for Economic Affairs» by the Swiss Federal Audit Office (SFAO) (22.8.2022) (summary in English)